IND 1634 In 17 Overs. 321-939-7013 Tuesday and Thursday 8am 12pm 1pm -.

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Web A rmy divers in Mexico have been blocked by debris in their attempts to rescue a group of miners who have been trapped in a flooded coal mine for more than a week.

. Web This post is also available in. The existing standard rate for GST effective from 1 April 2015 is 6. Web Local governments and school districts should have a say at court hearings on proposed property tax abatements for development projects that would cost cities counties and schools tax revenue a.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. ITC cannot be claimed if it is restricted in GSTR-2B available under Section 38. Web ATLANTA Local governments and school districts should have a say at court hearings on proposed property tax abatements for development projects that would cost cities counties and schools tax.

Web India Legends vs South Africa Legends Live Score Road Safety World Series 2022. Time limit to claim ITC on invoices or debit notes of a financial year is revised to earlier of two dates. 1st February 2022 Budget 2022 updates-1.

Stuart Binny Fifty Guides India. Latest Updates on ITC. Web ATLANTA - Local governments and school districts should have a say at court hearings on proposed property tax abatements for development projects that would cost cities counties and schools tax.

Web All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. Web Login issues with the PTP Customer Service Inquiry and DSMP. Melayu Malay 简体中文 Chinese Simplified MNCs in Malaysia.

One of the primary reasons MNCs are eager to set up a business base in Malaysia is due to the lower operational costs involved. Web The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018.

Web We are going to discuss the ineligibility of input tax credit in the article with examples. Malaysia is the third largest economy in South East Asia and has now become an upper middle income and export.

Elective Pass Through Entity Tax Wolters Kluwer

A Beginner S Guide To Filing Taxes In 2016

Elective Pass Through Entity Tax Wolters Kluwer

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Tax Considerations In Business Strategy Deloitte Insights

How To File Taxes If You Bought Crypto In 2021 Time

E News From The Eu Tax Centre E News 158 Kpmg Global

Post Merger Integration Services For Tax Deloitte Us

Inventory Is Not A Tax Deduction Using Inventory To Lower Taxes

E News From The Eu Tax Centre Special Edition Kpmg Global

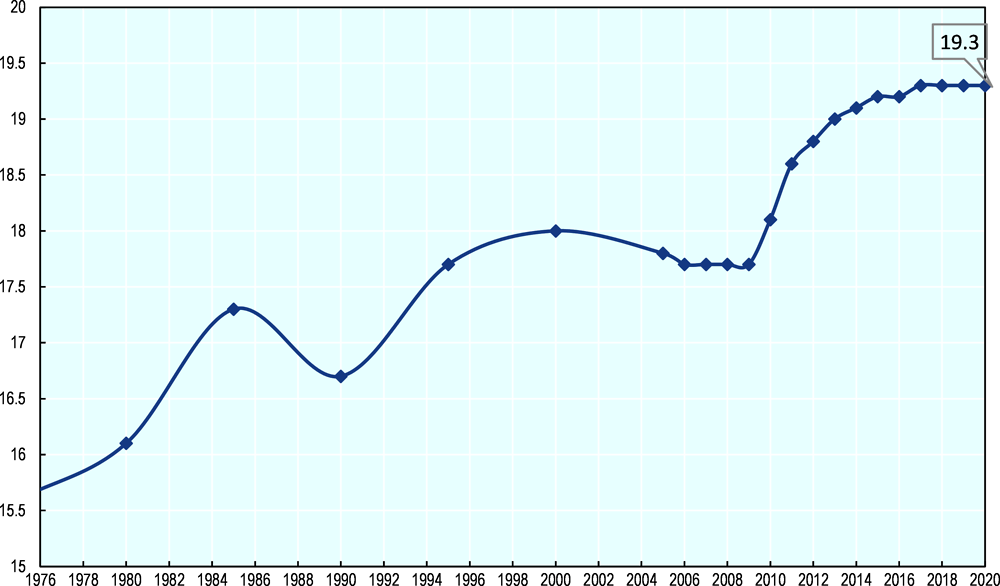

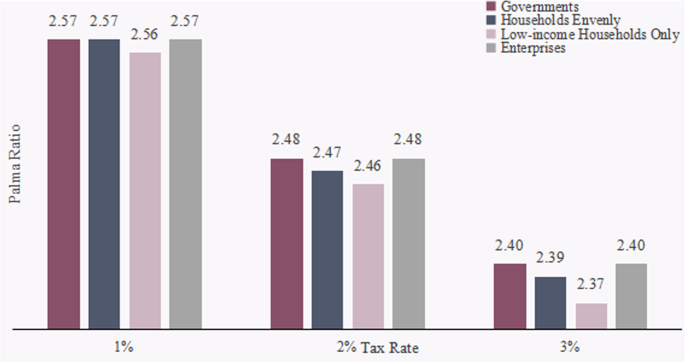

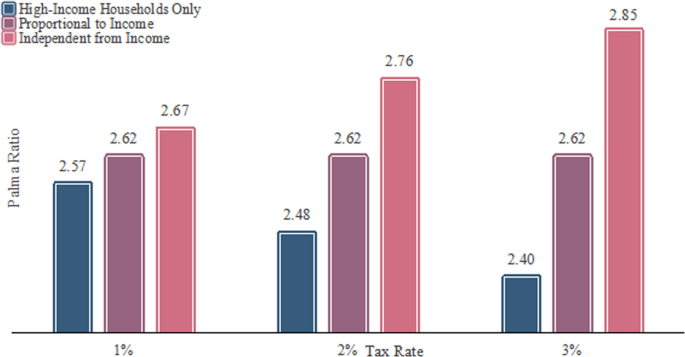

The Inequality Impacts Of The Carbon Tax In China Humanities And Social Sciences Communications

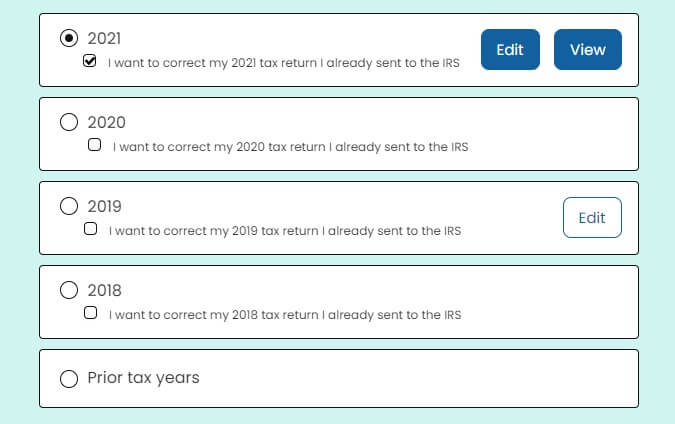

How To Amend An Incorrect Tax Return You Already Filed 2022

E News From The Eu Tax Centre Special Edition Kpmg Global

The Inequality Impacts Of The Carbon Tax In China Humanities And Social Sciences Communications

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

17 Free Painting Work Quotation Templates Ms Office Documents Work Quotes Painting Quotes Quotations